If you’ve been waiting for the “right moment” to buy, October could be it. National experts are pointing to mid-October as the most buyer-friendly window of the year.

Realtor.com explains: “By mid-October, buyers across much of the country may finally find the combination of inventory, pricing, and negotiating power they’ve been waiting for …”

That means October often delivers:

-

More homes to choose from

-

Fewer competing buyers

-

More time to shop deliberately

-

Better price flexibility

-

Sellers who are more willing to negotiate

But every market is different — so let’s look at what’s happening here in Baldwin County.

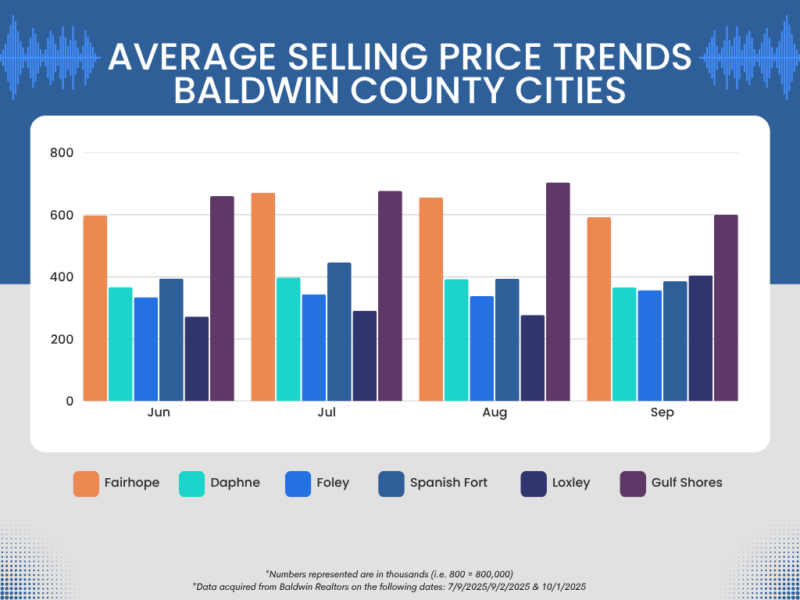

Baldwin County Market Snapshot — August & September 2025

The latest Baldwin Realtors® data shows some important late-summer shifts:

-

Fairhope: Average selling prices stayed steady through summer, hovering near $650K in July–August before dipping closer to $600K in September.

-

Daphne: Held steady in the $360K–$390K range, with a slight softening in September.

-

Foley: Mid-range prices between $370K–$400K, but stood out with the strongest September activity, closing 104 homes — the highest among Baldwin County cities.

-

Spanish Fort: Remains one of the most affordable options, with average prices just above $300K and a steady pace of sales.

-

Gulf Shores: Peaked above $680K in August before sliding closer to $600K in September — still among the priciest and most competitive coastal markets.

Mortgage Rates — September’s Surprise Dip

One more reason October looks promising: mortgage rates finally dipped in September.

-

The Federal Reserve cut rates in mid-September, and 30-year fixed mortgages fell to around 6.4% — the lowest level of 2025 so far.

-

Analysts expect rates could drift slightly lower toward the low-6’s by year-end.

This means Baldwin County buyers are entering fall with the best borrowing conditions of the year.

Pro Tip: Ask About Rate Locks and Float-Downs

When you find the right home, your lender may offer a rate lock — usually 30, 45, or 60 days — which guarantees your rate won’t rise before closing. Some lenders also offer a float-down option. This lets you take advantage of a lower rate if rates drop during your lock period (usually for a small fee or with certain conditions). That means you can shop with confidence: you’re protected if rates rise, but you won’t miss out if they fall before closing. Not all lenders offer this, so it’s worth asking up front.

Here’s what that looks like in real numbers financing $320K:

-

Buy Now at 6.4% → About $2,000/month

-

Wait for 6.0% → Save about $80/month … but if home prices rise (even a few percent), that savings disappears.

-

Buy Now + Refi Later → Lock in the home you want at today’s price. If rates drop, refinance and enjoy the lower payment later.

Bottom line: Buying now gives you control, while refinancing later gives you flexibility.

Why October Is Baldwin County’s Home Buying Sweet Spot

When you put it all together:

-

Inventory is rising as sellers list before year-end.

-

Competition is easing after the summer surge.

-

Negotiating power is stronger with longer days on market.

-

Rates are lower than at any other point in 2025.

That makes October a rare “golden window” for buyers in Baldwin County — a chance to find more options, pay less, and set yourself up for long-term value.

Final Takeaway

For Baldwin County buyers, October 2025 is lining up as the best moment of the year to make a move. Whether you’re drawn to the coastal lifestyle of Gulf Shores or the steadier inland markets of Fairhope, Daphne, Foley, or Spanish Fort, the data shows conditions leaning in buyers’ favor.

If you’re thinking about buying, let’s connect now so you’re ready to act quickly when the right home comes along this October.