When national headlines get noisy, the local real‑estate market often gets emotional. With the current federal government shutdown, you may have heard everything from “the market is frozen” to “nothing has changed.” The reality in Baldwin County—on Alabama’s Gulf Coast—is somewhere in between. Homes are still being shown, closings are still happening, but some supporting systems are running more slowly than usual. These slowdowns can create gaps if you’re not prepared. Here’s what’s actually happening, and what matters specifically right here.

What’s Being Affected Right Now

Several parts of the home‑buying and selling process rely on federal agencies—and those are the areas most at risk of slowdowns during a shutdown:

-

FHA, VA and USDA loan processing – These government‑backed loans don’t stop, but underwriting and verification may take longer. Keeping Current Matters+1

-

Flood insurance renewals and new policies – The National Flood Insurance Program (NFIP) and insurers in flood‑zones may pause issuance or renewals, delaying closings in zones designated by Federal Emergency Management Agency (FEMA). CBS News+1

-

Verification & agency bottlenecks – Private lenders may still issue conventional loans, but verifying tax transcripts, income, flood‑zone certifications can be delayed when agencies are furloughed. Yahoo Finance

These are primarily timing issues, not full deal‑stoppers. But timing matters—especially if your contract has tight deadlines.

What Makes Baldwin County Unique

Our Gulf‑Coast region (Baldwin County) has characteristics that change or heighten the impact of these issues:

Our Gulf‑Coast region (Baldwin County) has characteristics that change or heighten the impact of these issues:

-

A relatively high number of buyers eligible for VA and USDA programs (especially retirees, second‑home buyers)

-

Many homes located within FEMA flood zones, where flood insurance is required for financing

-

A steady stream of relocating retirees, second‑home and investment buyers — so demand remains strong

-

Growing population and coastal lifestyle appeal supporting long‑term market strength

Because of these factors, the shutdown doesn’t stop our market — but it tends to create division between those who are prepared and those who are not. Prepared buyers and sellers still move smoothly; the unprepared get frustrated.

Advice for Buyers

If you’re purchasing right now, keep your strategy sharp:

-

Talk with your lender early about your loan type and timing. If you’re using FHA, VA or USDA financing, ask how the shutdown may affect underwriting and closing.

-

If your property is in a flood zone, verify the status of current flood‑insurance coverage and check with your insurance agent about renewal/new‑policy timing.

-

Use this moment to your advantage: some buyers may step back out of caution — meaning less competition = more negotiation room.

-

Build extra buffer time into your closing schedule if possible.

Advice for Sellers

For sellers in Baldwin County:

-

Expect your buyer’s lender may need more time than usual — be ready for extra communication and documentation.

-

If you already have flood insurance, renewing early (rather than waiting for the buyer’s side) can avoid timeline glitches.

-

Homes that are well priced and presented are still selling — but the offers may be more thoughtful, not rushed.

-

Having a local agent who understands how to manage momentum in a slower‑moving process matters more than ever.

Advice for Investors

From an investment perspective: this environment can present strategic opportunities:

-

Well‑capitalized investors often use uncertain periods to acquire properties with less competition.

-

Rental demand remains strong on the Gulf Coast — especially around Fairhope, Daphne, Spanish Fort, Foley and the Eastern Shore.

-

Investors who succeed now are those who:

-

Understand flood‑zone exposure and insurance implications

-

Have lending flexibility (not solely relying on delayed federal‑backed programs)

-

Work with a team who can model long‑term return, not just purchase price

-

The Market Doesn’t Stop — It Adjusts

History shows us that shutdowns slow, but don’t stop the housing market. For example, during the 2018‑2019 shutdown, national sales dipped slightly then rebounded quickly once agencies reopened. luminate.bank

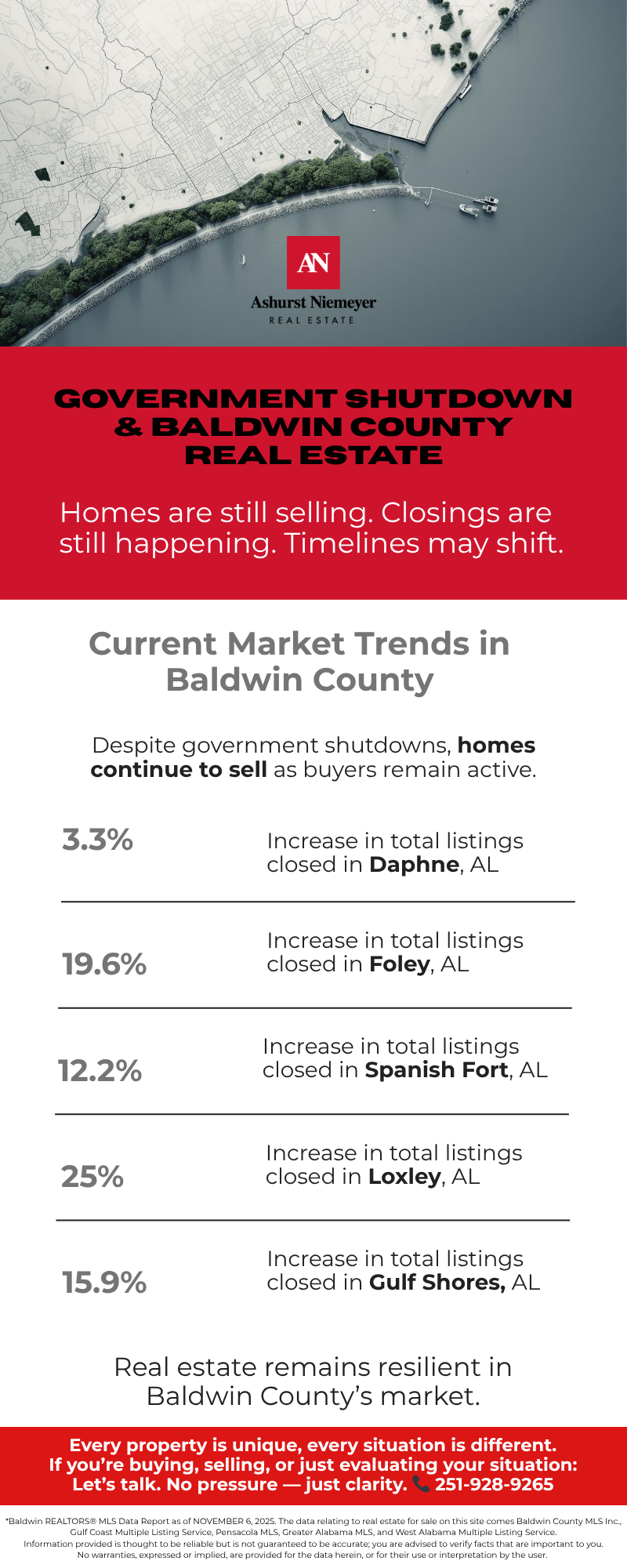

Here are the residential sales numbers for October 25 compared to October 24.

The key point: in uncertain seasons, your value lies in a trusted advisor who understands your goals, your financing structure and your market — not in flashing headlines.

Why the Team at Ashurst Niemeyer is Here for You

We’ve served the Gulf Coast community for decades. We understand how national policy connects to local reality here in Baldwin County. Real estate decisions should feel thoughtful—not rushed or reactive. If you’re buying, selling, or simply evaluating your situation, let’s talk. No pressure—just clarity.

📞 251‑928‑9265

Steady is a strategy. You don’t have to navigate this season alone.

FAQ

Q: Can I still close a home purchase during the government shutdown?

A: Yes — most deals still go through. However, if you’re using an FHA/VA/USDA loan or need new flood insurance in a flood zone, you may experience extra days or weeks of delay. Keeping Current Matters+1

Q: Does the shutdown affect conventional mortgages?

A: Less so. Conventional loans are mostly issued by private lenders and don’t rely as heavily on federal‑agency operations. However, some verifications (e.g., tax transcripts via the IRS) may still be delayed. CBS News

Q: What if my property is in a FEMA flood zone?

A: You’ll want to check early. The NFIP may suspend new or renewal flood policies during the shutdown, and lenders typically require flood insurance before closing. That can delay your closing if not addressed early. investopedia.com

Q: Is this a good time to invest or sell?

A: For investors: yes — fewer competitors may create opportunity. For sellers: if your home is well prepared, you can still get good results. The key is staying patient and ready for slightly slower processes.

Conclusion

In Baldwin County, the effects of the federal government shutdown are real—but they don’t have to derail your real estate journey. With preparation, the right team, and clear understanding of what’s happening, you can stay ahead. Let’s make sure you’re equipped, not anxious.