In Baldwin County, it’s not that people don’t want to buy a home.

It’s that a lot of would-be buyers assume they can’t.

They’re watching homes in Fairhope, Daphne, Spanish Fort, Foley, Gulf Shores, Orange Beach, Robertsdale, Loxley (and all the hidden gems in between)… and telling themselves:

“My credit isn’t good enough. I’m not ready.”

That belief is one of the biggest reasons buyers stay renters longer than they need to.

A Bankrate survey found 42% of Americans believe you need excellent credit to qualify for a mortgage.

And that myth hits even harder here—because with our mix of coastal living, growing demand, and competitive price points, people assume the bar must be sky-high.

Here’s the truth:

Quick answer: No, you don’t need perfect credit to buy a home here.

Quick answer: No, you don’t need perfect credit to buy a home here.

There isn’t one magic credit score that unlocks homeownership.

FICO (the scoring system many lenders use) says it clearly: there’s no single cutoff score used by all lenders, and lenders look at more than just your score.

And if you’re considering an FHA loan, the National Association of REALTORS® notes buyers may qualify with:

-

580+ for 3.5% down

-

500–579 for 10% down

So if your credit isn’t “perfect,” that doesn’t mean the door is locked. It usually means you need the right strategy.

Why the myth feels true in Baldwin County

A lot of recent buyers do have strong credit, which makes it easy to think that’s required.

The New York Fed has reported elevated mortgage credit scores in recent years (including reporting around the low-to-mid 700s+ for many buyers).

But those numbers describe who is buying—not who can buy.

Here’s what matters locally: Baldwin County buyers aren’t one-size-fits-all.

We see:

-

First-time buyers trying to get close to downtown Fairhope

-

Move-up families looking in Daphne/Spanish Fort for schools and space

-

Buyers relocating for the coastal lifestyle (often with equity, sometimes without)

-

Investors eyeing long-term rentals (and learning quickly that financing isn’t just about credit)

Which means your options depend on your full financial picture—not just a score you checked on your phone at 11:30 p.m. after doom-scrolling Zillow.

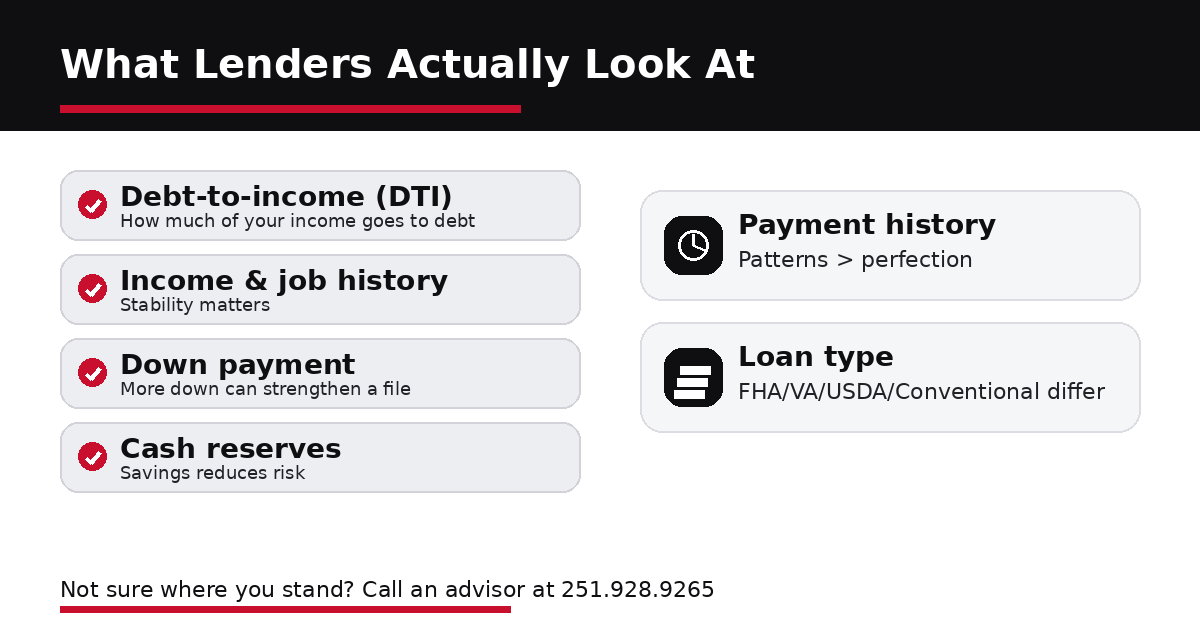

What lenders look at besides your credit score (especially for our market)

Your credit score matters—but lenders also look at:

-

Debt-to-income ratio (DTI): how much of your monthly income goes to debt

-

Income & job history: stability matters

-

Down payment: more down can strengthen approval terms

-

Cash reserves: extra savings helps (especially when costs stack up)

-

Payment history patterns: consistency matters more than perfection

-

Loan type: FHA/VA/USDA/conventional all play differently

And here’s the Baldwin County-specific reality:

Your “all-in” monthly payment may include more than principal + interest

Depending on the property and location, buyers here may be looking at:

-

HOA dues (common in neighborhoods and condo communities)

-

Insurance variables (especially closer to the water)

-

Flood considerations in certain zones

That’s why getting a local lender to run your real numbers matters so much. A pre-approval isn’t just paperwork—it’s clarity.

A realistic “credit score range” guide (not a promise—just a compass)

Every lender has its own rules (and many add “overlays,” meaning stricter standards than the basic program). But here’s a helpful baseline:

-

Conventional loans: You’ll often hear 620 as a common starting point—CFPB notes some loans require a minimum score of 620 unless you have a larger down payment.

-

FHA loans: Potentially 580+ for 3.5% down; 500–579 may qualify with 10% down.

Translation: if you’re in the 600s (or even high 500s), the conversation may be worth having—especially with the right loan path.

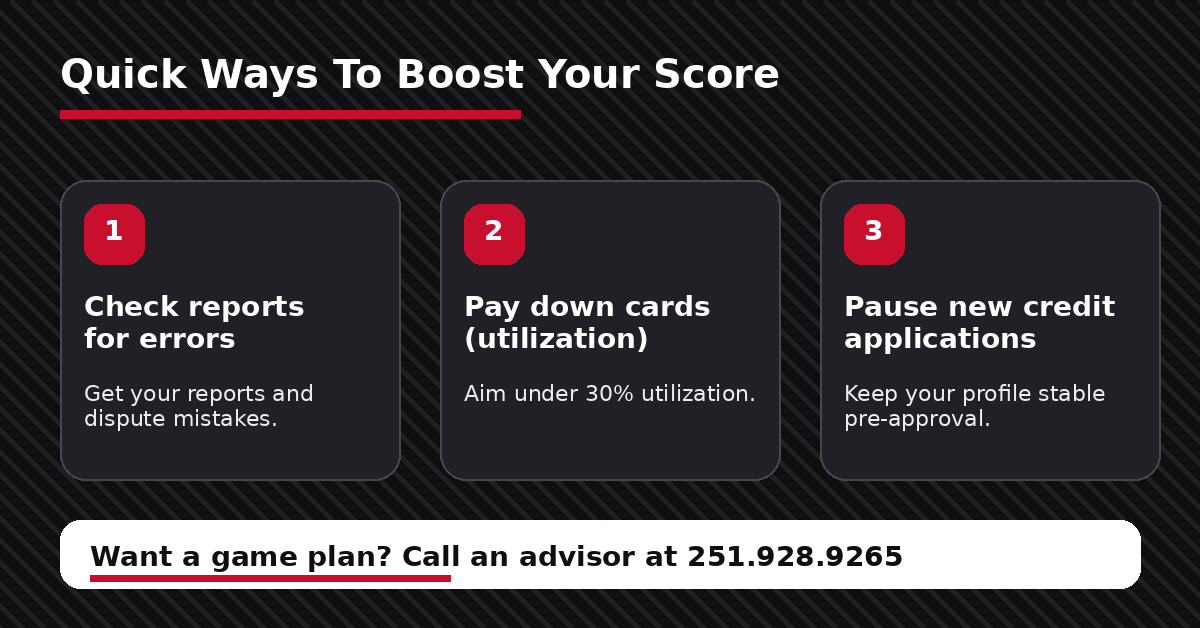

If your score is “almost there,” these moves can help fast

Not gimmicks. Real levers that often move the needle.

1) Pull your credit reports (and look for errors)

You can access official reports at AnnualCreditReport.com, and free weekly online credit reports are available.

Also, the FTC notes you can get six free Equifax reports per year through 2026 in addition to your annual reports.

2) Pay down credit card balances (utilization matters)

Credit utilization (how much of your available credit you’re using) is a big factor. CFPB recommends keeping utilization under 30%.

Experian notes your score will typically improve in one to two months after paying down revolving debt, once reporting updates.

3) Don’t open new accounts right before applying

New credit can create temporary score dips and adds uncertainty right when you want stability. Experian also recommends limiting new credit applications while improving your score.

4) Don’t carry a balance “for your score”

Carrying a balance is a popular myth. MyFICO explains you don’t need to carry a credit card balance to improve your FICO Scores.

Bottom line

Your credit score is important—but it doesn’t have to be flawless to start your homebuying journey.

If credit has been your “stop sign,” let’s turn it into a yield sign.

At Ashurst Niemeyer, we can help you get clarity on next steps and connect you with a trusted local lender to explore real options—without pressure and without guesswork.

📞 Call an advisor at 251.928.9265.

Educational information only. Loan approval, rates, and program eligibility vary by lender and borrower qualifications.

FAQs

Can I buy a home in Baldwin County with a 600 credit score?

Sometimes, yes—depending on the loan type, your down payment, DTI, and lender guidelines. FHA programs can be more flexible than conventional.

Does checking my credit hurt my score?

Checking your own credit report is a soft inquiry and doesn’t hurt your score.

How quickly can my score improve?

If high credit card balances are the issue, improvements can show up in 1–2 months after balances drop and reporting updates.

Do I need perfect credit to get approved?

No. FICO states there’s no single cutoff score used by all lenders, and lenders evaluate multiple factors.